Note: everything in this piece is a strictly personal view

The UK, in common with every other country, needs to spend a lot of money tackling climate change. We need to limit the planet’s warming to as low a level as possible, by eliminating carbon emissions. And we need to adapt as best we can to the consequences of climate change, both those that are already with us and those we can’t avoid.

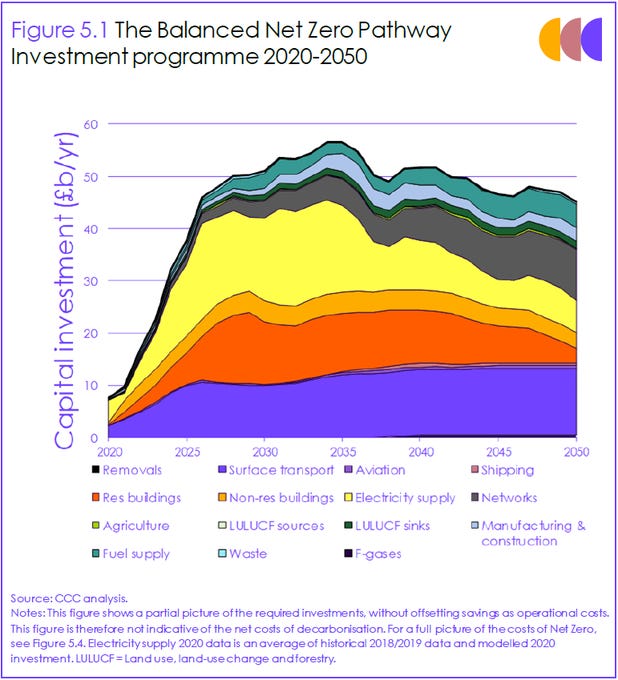

Tackling climate change – both reducing emissions and adapting – is a capital-intensive activity. In the UK, the Climate Change Committee estimates we will need to invest around £50 billion a year to achieve net zero carbon emissions, and a further £10 billion in climate adaptation. That is total investment needed, across both public and private sectors, and amounts to somewhere between 2% and 3% of GDP. The committee also estimates a significant proportion of this cost would be recovered through lower running costs, putting the total cost below 1% of GDP. It’s important to stress that the state does not need to do all - or even the majority - of this spending, but it certainly needs to do a fair share of it.

If this sounds expensive, it is nothing compared to the cost of not taking action on climate change. Estimates of the cost of climate change vary – it is an exceptionally difficult thing to quantify – but they almost invariably suggest that climate inaction will cost more than climate action. The LSE’s Grantham Research Institute, for instance, found that on current policies the costs of climate change to the UK would reach 3.3% of GDP by 2050, and 7.4% by 2100. With effective global action, this loss would reduce to 2.4% by 2100. And an economic analysis like this can’t easily factor in the risk of more serious, potentially existential risks from climate change.

But while the case for investing to tackle climate change is overwhelming given the huge risks it addresses, most governments do not treat climate spending any differently from other kinds of spending. This means that governments, including the UK’s, frequently prioritise spending on nearer-term priorities over tackling the long-term risk from climate change.

To address this, I propose introducing a Climate Fiscal Rule, which would exempt all legitimate government spending on climate change from the government’s fiscal rules. This would enable governments to spend what is needed – ideally, what is economically optimal in the long term – on reducing carbon emissions and adapting to climate change without having to trade it off against other, immediate priorities.

***

There are several reasons why a Climate Fiscal Rule makes sense and is indeed a fiscally responsible thing to do.

First, climate spending increases a country’s long-term fiscal sustainability, by reducing future losses to government and the economy and increasing its ability to service its debts and borrowing. Given that the main aim of fiscal rules is to preserve a country’s fiscal sustainability, treating climate change in this way seems entirely in line with the aim of fiscal rules.

Second, removing climate spending from fiscal rules would remove the competition between long-term commitments on climate change and short-term priorities. This would enable a more economically optimal, consistent approach – perhaps with the level of climate spending to be determined by an independent body, such as the Climate Change Committee or OBR.

Third, borrowing money now to tackle climate change is fundamentally the best route to inter-generational fairness. It is much better – in economic and in moral terms – to leave future generations with a bit more debt than to leave them with a ruined climate.

Ultimately, a state that treats climate change spending separately from the rest of its spending is likely to be a more fiscally sustainable and more inter-generationally just state.

***

There are, of course, plenty of counter-arguments available to this proposal. Let me try to deal with a few obvious ones.

Isn’t this just you picking out your pet issue and saying we should be able to spend unlimited money on it? What’s to stop us having the same protection for the NHS spending, or any other line of spending?

To be frank, if you can make this line of argument you probably don’t understand the severity of the risks from climate change. Climate change will have a huge negative impact on our economy and our society, and this will get exponentially worse if we delay or fail to take action. There are very few other issues – perhaps AI and nuclear war – that carry the same degree of risk that climate change does. But the risks from climate change are much better understood, and tackling them requires significant investment which appears to be healthily cost-beneficial.

(I should note here that I am emphatically not a climate doomer. I’m pretty optimistic that we can and will avoid the worst climate change scenarios, and I think the prospect of human extinction is low, if uncomfortably high. But anyone who’s had any clear-eyed exposure to the consequences of climate change knows that its consequences are still incredibly serious. There is a huge space between “we’re all doomed” and “it will all be fine”, and that’s the space that I – like most people who work in good faith on climate change – operate in).

The most significant costs of climate inaction happen a long way into the future – is it right for the government to have such a long time horizon, or should it leave that to future generations?

This is the main argument HM Treasury makes against borrowing to tackle climate change in its net zero review (key passage below). There is a lot to take issue with in this view, but the key point is that the costs to future generations of a ruined climate will far, far outweigh the cost of servicing some extra debt to avoid that scenario.

One might argue that the state just shouldn’t worry so much about the long view out as far as 2100, but I would argue that this is exactly what the state is for – to take long-term decisions that individuals cannot. If the UK state is not planning to be around and healthy by 2100, I would have serious concerns about that.

What’s to stop governments smuggling all kinds of its preferred spending in under a “climate” banner?

This is a valid concern, and something that needs to be carefully addressed. All spending marked as climate spending would be independently verified as climate-relevant, by a body such as the Climate Change Committee. Ideally, only spending which was economically optimal (most importantly, that the future benefits and avoided losses outweigh the costs) would be eligible to be included. Financing this climate spending through sovereign green bonds – with investors lending money to government explicitly interested in climate goals – might also help to provide scrutiny on this.

The UK can’t have a meaningful effect on emissions by itself, so isn’t it pointless to invest in reducing our emissions when other bigger countries won’t?

It is true that reducing carbon emissions requires global, not national action, but this viewpoint entirely overlooks the dynamics of how emissions reduction works. If countries like the UK – which have both a moral obligation and a technical advantage – don’t lead the way on decarbonisation, other countries such as China and India will not follow. UK decarbonisation is a prerequisite for global decarbonisation, and it can help forge a path for other countries to follow. More prosaically, if the UK does not decarbonise its economy while most other advanced economies do (spoiler: they are currently doing this), it will find itself effectively locked out of parts of the global economy.

Won’t this just make UK government borrowing unaffordable, and lose the confidence of the bond markets?

There is always some degree of risk in additional government borrowing (at least when the economy is supply-constrained), and there is also a risk that markets do not view climate spending as increasing fiscal sustainability, not over the time horizon they care about at least. I think it is probably true – as this paper for the European Parliament concluded – that a Climate Fiscal Rule would reduce fiscal sustainability in the short term, but increase it in the longer term.

However, I think the extent of this risk would be fairly limited, and justified by the long-term benefits of a Climate Fiscal Rule. Governments that act broadly responsibly – including by setting and following fiscal rules, even if they are routinely changed – rarely encounter major problems. There is also the option to course-correct if necessary. Having a Climate Fiscal Rule would not and should not have to mean abandoning fiscal responsibility, but rather putting more emphasis on long-term risks.

Why not just exempt all investment from fiscal rules, given that it helps the economy grow and increases fiscal sustainability?

I broadly support this idea – and it would have substantially the same effect for climate change, since most climate change spending is investment. The case against exempting all investment from fiscal rules is, I think, the same as the argument above – it increases the risk of a government losing market confidence. I think this risk is probably overstated, provided the investment is carefully chosen and clearly increases growth prospects.

But what a Climate Fiscal Rule offers is a more limited, focused alternative to exempting investment from fiscal rules, which has a clear link to fiscal sustainability and a strong moral argument on inter-generational fairness behind it.

***

There will be a lot of debate about spending on climate change ahead of the next UK election, particularly given that it forms the Labour Party’s most eye-catching economic policy. Much of that debate will be about whether a weakened UK economy can really afford to invest so much in tackling climate change. The real debate, of course, should be about whether we can afford not to take climate action. A Climate Fiscal Rule could lift us out of such arguments, and ensure we can take real action on one of the most serious challenges we have ever faced.